If you want to invest in Gold bullion coins, it’s important to understand the difference between the different coins. Almost all first-world countries mint their own Gold coins so it can be a bit confusing to know which ones to buy.

In this blog, we will start by discussing the difference between the two most well-known coins, the Gold Britannia coin and the Gold Krugerrand coin.

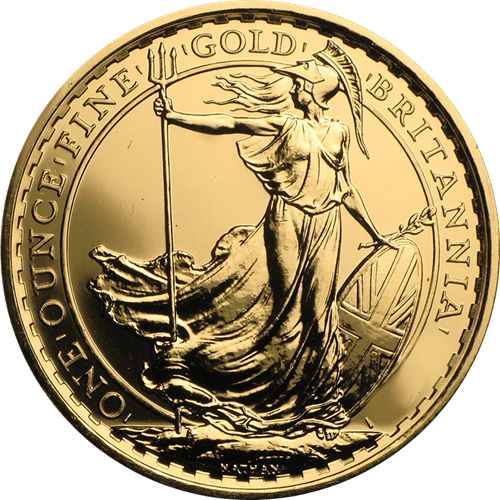

The Gold Britannia Coin

The Gold Britannia coin is the most well-known gold coin in the UK. It was first minted in 1987 with a face value of £100. It is one of the most popular coins amongst British investors. The Britannia coin was originally created as a 22-carat coin, but in 2013 it was switched to a 24-carat coin. It became a bigger coin with a diameter of 38.61mm. A year later in 2014, it was changed back to its original size of 32.69mm and 31.1grams but remained a 24-carat Gold coin. Both the 24-carat and 22-carat Gold Britannia coins have the same value.

On the head of the Gold Britannia coin, you will see Queen Elizabeth II. On the back of the coin is a portrait of Brittania, a Roman goddess of battle and guardian of the seas. Britannia is recognised worldwide as a trusted symbol of British National pride and the quality of British minting.

Buying physical gold like the Britannia Gold coin has tax benefits in the UK; it is exempt from capital gains tax and VAT. In addition, Gold bullion coins can be exchanged for cash, goods and services all over the world.

Every October we see a shortage of Brittania Gold coins as the Royal Mint create the next year’s coin during the month of October. So at the moment, they are printing the 2023 coin.

The crrent value of the Gold Britannia Coin is:

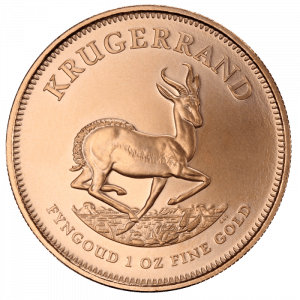

The Gold Krugerrand Coin

The Gold Krugerrand coin was the world’s first bullion coin, minted in South Africa. It was first produced in 1967 and since then has remained the most traded Gold coin globally.

It is 22-carat Gold and has a purity of 91.67%; the remaining percentage is made up of copper, which makes the coin highly durable. This means that the coin has fewer wear and tear marks than other coins of a certain age.

On the head of the coin, you will find the 3rd President of The South African Republic, Paul Kruger. This is why the coin was named the Gold Krugerrand, a combination of Kruger and the South African currency “the rand.” The reverse of the coins features the Springbok, South Africa’s national animal.

The Krugerrand is a popular choice for UK investors as it is VAT free. In addition, it has a consistently low price, making it a great choice for first-time investors.

Both the Britainna and the Krugerrand coins are equal to 1oz of gold. In terms of the value of Gold, they both have the same amount of Gold but they are priced differently. The Britannia is usually cheaper because it is made in the UK and the Krugerrand is coming from South Africa. Nevertheless, right now The Britannia is more expensive because of the current changes happening within the Royal Family.

If you have more in-depth questions about the different types of Gold coins, you can drop us an email or even come and see us in London.