Welcome to our informative blog post where we delve into the differences between Britannia bars and coins. If you’re considering investing in gold, understanding these distinctions can help you make an informed decision. The Royal Mint has its sub brand of gold bars called ‘Britannia’, but it’s don’t confuse them with the globally recognized Britannia coins. We will explore key points such as pricing, availability, recognition, and tax advantages to help suggest the benefits of Gold Britannia coins over Britannia bars

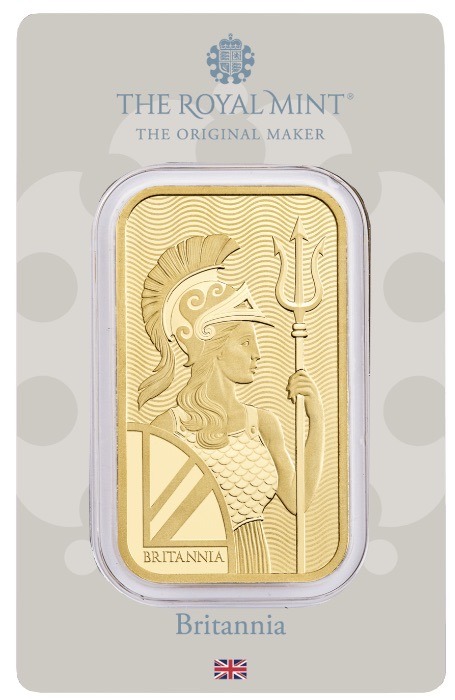

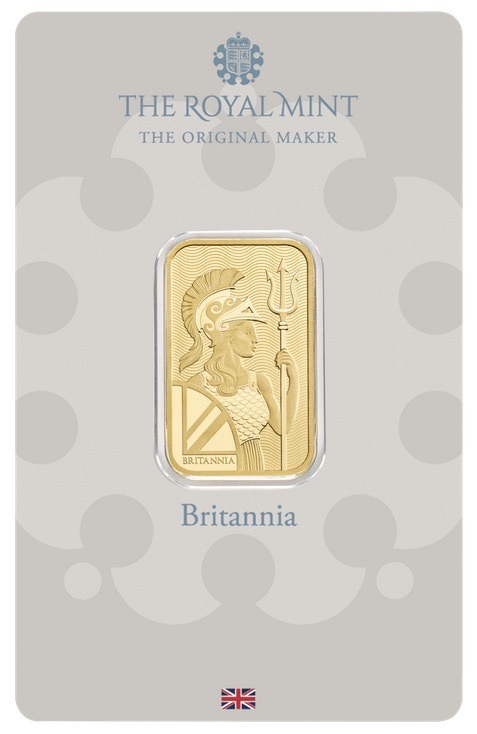

- The Royal Mint of the UK refers to its minted wafer bars as ‘Britannia’,. These are not be confused with Gold Britannia coins.

- The term ‘Britannia’ is exclusive to the Royal Mint. Other major refineries, like Metalor, use the term Minted Wafers for similar products.

- The Royal Mint’s sub brand, Britannia gold bars, comes in various sizes. However, other refineries offer a wider range of gold bars.

- Britannia bars, as a sub brand, usually command higher prices and may not enjoy the same level of global recognition as Gold Britannia coins. At J Blundell and Sons, we offer LBMA approved gold wafer bars, which can be more cost-effective.

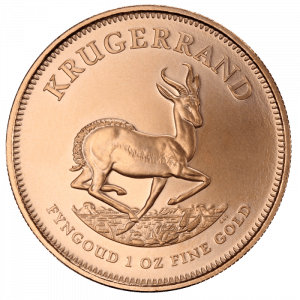

- Gold Britannia coins hold global recognition and acceptance, guaranteeing their high liquidity in international markets. Investors can effortlessly buy and sell these coins, granting them flexibility and access to a diverse pool of potential buyers.

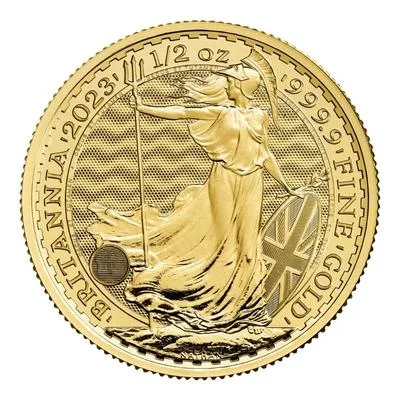

- Gold Britannia coins are available in various denominations, including 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. Thus allowing investors to choose the size that aligns with their budget and investment goals.

- These coins are exempt from Capital Gains Tax (CGT) in the UK. Hence making them an attractive investment option for those seeking tax advantages.

It’s important to understand the distinction between the Royal Mint’s ‘Britannia’ bars and Gold Britannia coins. While the term ‘Britannia’ is specific to the Royal Mint, Gold Britannia coins are widely recognized and accepted in global market. We offer a range of gold investment options, including LBMA approved gold bars and Gold coins, providing investors with choices.