When it comes to investing in precious metals, the quality and authenticity of the product are critical. This is where the London Bullion Market Association (LBMA) comes into play. In this guide, we’ll delve into the importance of LBMA accreditation and why you should consider buying 24k gold bars from LBMA accredited refiners.

Understanding the LBMA and Its Importance

The LBMA is a highly respected institution in the precious metals market. Membership with the LBMA provides credibility and recognition in the global market, meaning that the refiner meets the high standards set by the LBMA.

Why Buy from LBMA Approved Refiners

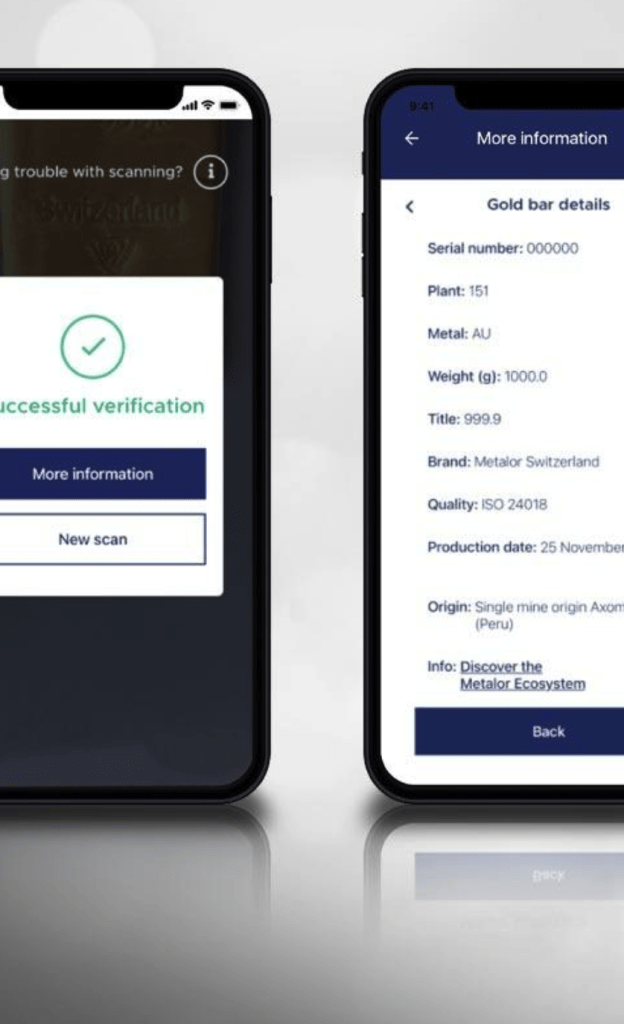

Purchasing gold bars from LBMA approved refiners comes with several advantages. They adhere to strict quality and ethical standards, ensuring that the precious metals produced are of high quality and have been sourced responsibly. This reduces the risk of buying counterfeit or substandard products. Regular audits of LBMA approved refiners provide another layer of assurance for buyers.

Different Membership Types with LBMA

The LBMA has different membership types, each with its own set of obligations and requirements. Here’s a quick overview:

| Membership Type | Description | Voting Rights | Participation in LBMA Activities |

|---|---|---|---|

| Market Making Members | Obliged to make markets in either gold or silver, or both. | Yes | Can nominate individuals to serve on the Board. |

| Full Members | Engaged in activities closely related to the London bullion market but are not market makers. | Yes | Can participate in LBMA committees and working groups. |

| Associate Members | Engaged in activities related to the London bullion market but do not qualify for Full Membership. | No | Can participate in LBMA committees and working groups. |

| Affiliate Members | Not closely engaged in the London bullion market but have an interest in the market. | No | Limited participation in LBMA activities. |

All members have the right to attend general meetings, with varying levels of participation in LBMA activities.

LBMA’s Responsible Sourcing Programme

The LBMA’s Responsible Sourcing Programme ensures the continuous improvement of responsible sourcing business practices. It reassures clients that all of the metal sourced from LBMA Good Delivery Refiners is free from threat financing. The programme focuses on:

- Value Chain Accountability: Building the awareness, trust, and mutual confidence of stakeholders in the precious metals value chain to increase accountability and enhance collaboration.

- Advancing Standards: Advancing responsible sourcing standards and business practices to strengthen refiners’ risk assessment practices and provide more focus on progressive risk mitigation.

- Audit Programme: Strengthening the robustness of Step 4 of the Responsible Sourcing Programme to improve confidence in the assurance process.

- Transparency: Enhancing disclosure against Step 5 of the Responsible Sourcing Programme to improve the transparency of the precious metals supply chain.

- Artisanal Small-Scale Mining (ASM): Encouraging and facilitating responsible engagement by refiners in the precious metal supply chains of Artisanal and Small-Scale Mining.

Choosing the Right 24k Gold Bars for Investment

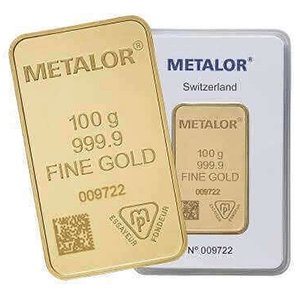

When it comes to choosing the best gold bars to buy for investment, consider the purity of the gold. 24k gold bars are the purest form of gold you can buy. They are a great investment option as they hold intrinsic value and are highly liquid. When purchasing, look for LBMA accredited refiners to ensure the quality and authenticity of the gold bars.

In conclusion, buying gold and silver bars from LBMA accredited refiners is a smart move for any investor. It ensures the quality of your investment and provides peace of mind knowing that your precious metals have been sourced responsibly. At JBlundells, we only sell gold and silver bullion from full members with LBMA accreditation, such as the Royal Mint and Metalor. Remember, understanding the importance of LBMA accreditation is key to making informed investment decisions.