As the world watches significant changes in global leadership, one thing is clear: political shifts can have a profound impact on financial markets, particularly precious metals like gold. With Donald Trump’s presidency, many factors point toward a bullish outlook for gold prices. At J Blundells & Sons, we explore why Trump’s policies and the economic environment during his tenure, may make gold a prime investment choice.

Economic Uncertainty Sparks Gold Demand

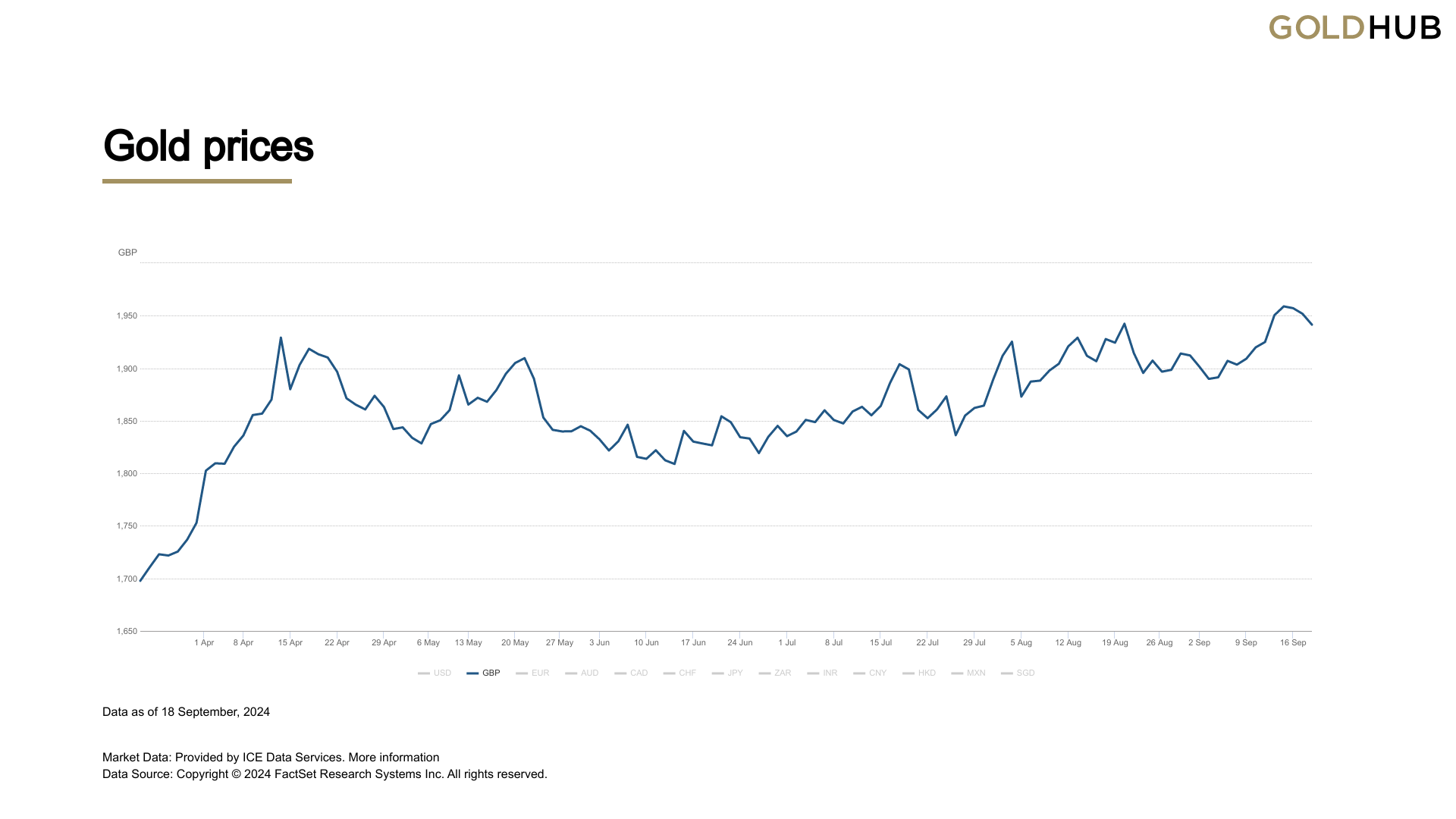

Trump’s presidency introduced a new era of economic policies, including significant tax reforms and an America-first trade agenda. While these moves aimed to bolster the U.S. economy, uncertainty surrounding international trade and global markets often leads investors to seek safe-haven assets like gold. Historically, during periods of geopolitical or financial uncertainty, gold prices have seen significant gains.

Inflationary Pressures on the Horizon

With Trump’s focus on infrastructure spending and stimulating domestic industries, increased government spending is likely to raise inflation expectations. Gold is a proven hedge against inflation, and as prices rise, so does the allure of gold as a way to preserve purchasing power.

Weaker Dollar, Stronger Gold

Gold prices often move inversely to the strength of the U.S. dollar. Trump’s protectionist policies and trade negotiations with major economies like China could lead to short-term volatility in the dollar’s value. A weaker dollar typically makes gold more attractive to foreign investors, driving up demand and prices.

Market Volatility Boosts Safe-Haven Assets

Trump’s unconventional leadership style and the unpredictability of his policies often led to market volatility. During such times, investors turn to gold to safeguard their portfolios, creating upward pressure on gold prices.

Long-Term Security for Investors

As Trump’s administration navigates economic challenges, the global appetite for a secure and stable investment will continue to grow. Gold offers that security, making it an ideal choice for diversifying portfolios amidst political and economic transitions.

Why Invest in Gold Now?

Gold isn’t just a precious metal; it’s a timeless store of value. With Trump’s presidency highlighting both opportunities and uncertainties, the case for investing in gold becomes even stronger. At J Blundells & Sons, we provide a trusted source for gold investments, helping our customers secure their financial future during transformative times.

Why Choose J Blundell & Sons?

J Blundell & Sons, trusted since 1939, is a family-run bullion dealer based in Hatton Garden, London. We offer expert advice, competitive prices with a Price Match Guarantee, free and fast secured delivery, and a reliable buy-back option for any items purchased. With decades of experience, we’re the trusted choice for gold investment. Learn more about the vast selecetion of gold bullion we offer here.

Conclusion

While Trump’s policies may contribute to a favourable environment for rising gold prices, other global economic factors, central bank policies, and geopolitical events also play a critical role. Investors should monitor the broader market and seek expert advice when considering gold investments.

Contact J Blundells & Sons today to learn more about how we can help you invest in this timeless asset.