When it comes to investing in gold, authenticity is key. As a UK investor, you want assurance that your gold is not only genuine but also of the highest purity. At J. Blundell and Sons, a well trusted gold-dealer, we go above and beyond to ensure the authenticity of your gold investments. In this guide, we’ll walk you through exactly what certifying your gold means and its importance. Whether you are looking to invest in Gold Bars or Gold Coins, buying with confidence is key.

The Importance of Gold Authenticity

Gold authenticity certificates are official documents that verify the purity and authenticity of your gold items. These certificates serve as concrete proof of the quality and value of your investment, making them essential for UK investors looking to buy or sell gold.

What To Expect From A Certificate?

You can expect to find key information included within your certificate, this includes:

- Karat and Purity: Specifies the gold’s karat value, indicating its purity level.

- Weight: Mentions the gold item’s weight in grams or troy ounces.

- Description: Provides a detailed description of the item, including any gemstones.

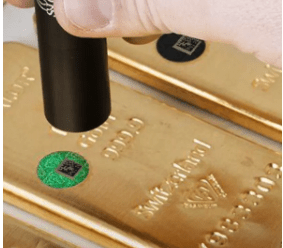

- Hallmarks: Lists any hallmarks or stamps present on the gold item.

- Authentication Details: Includes information on the methods used to verify purity.

- Date of Certification: Displays the certificate’s issuance date.

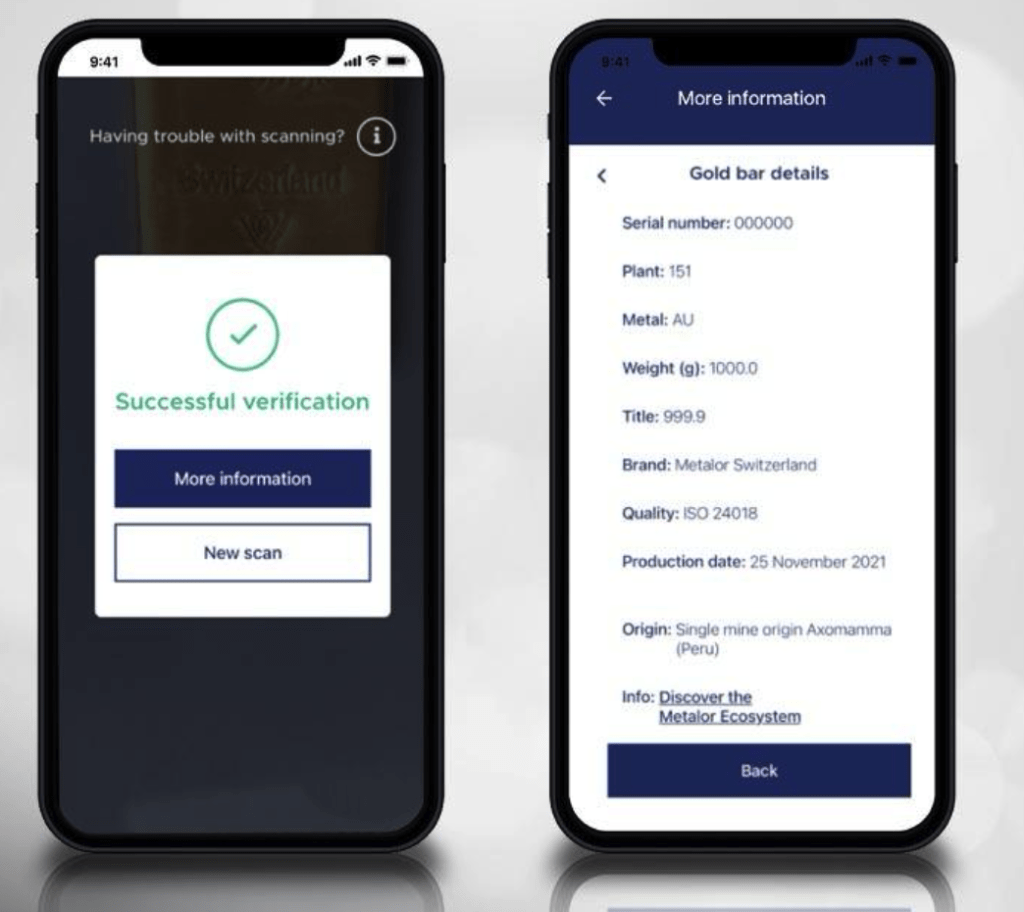

- Digital Copy: Offers secure storage of a digital copy for your convenience.

- Issuer Information: Features J. Blundell and Sons’ name and contact details.

What Does A Certificate Offer?

Investors value authenticity certificates for their gold investments for several key reasons. These certificates act as undeniable proof of gold purity and karat value, instilling confidence. In the complex world of gold investments, where quality significantly affects value, this assurance is crucial.

Additionally, authenticity certificates provide a clear assessment of market worth. This clarity aids in making informed investment decisions and ensuring fair transactions. When issued by trusted entities like J. Blundell and Sons, these certificates enhance an investor’s credibility and trustworthiness, making them more appealing to potential buyers or sellers.

Furthermore, these documents simplify record-keeping, assist in estate planning, inheritance, and offer legal protection. These aspects are vital for serious gold investors looking to protect their assets and make sound financial choices.

Conclusion

In summary, authenticity certificates offer transparency, credibility, and peace of mind to investors in their gold investments. They provide clear proof of the gold’s quality and value, boosting confidence and helping with smart decisions. These documents, especially when issued by trusted sources like J. Blundell and Sons, make investors more trustworthy and ensure fair deals. Additionally, they make it easy to keep records, plan for the future whilst keeping you legally protected. All in all, authenticity certificates offer clarity and peace of mind for investors in the world of gold investments.