As an investor, you may have heard the term “LBMA approved gold bullion” thrown around. But what exactly does it mean, and why is it important for your investment portfolio? In this post, we will delve into what LBMA is, why it is a global standard, and explain LBMA accreditation in simple terms.

What is LBMA?

LBMA stands for the London Bullion Market Association, an international trade association that represents the wholesale market for gold and silver in London. It was founded in 1987 by the Bank of England and a group of bullion traders in response to growing concerns about market transparency and integrity.

The LBMA operates on a not-for-profit basis and sets standards for the quality and production of gold and silver bars. It also oversees the Good Delivery List, which is recognized as the international benchmark for the quality of gold and silver bars.

Is it a global standard?

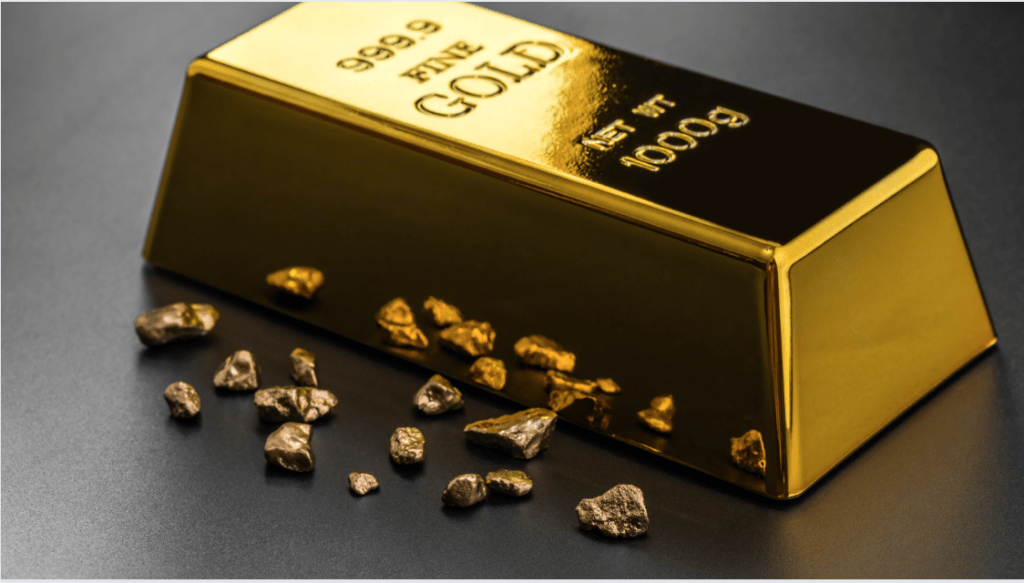

Yes, the LBMA is recognized as a global authority on the physical precious metals market, and its standards for gold bullion are widely accepted by traders, investors, and refiners around the world. To be approved by the LBMA, a manufacturer must meet strict criteria regarding the quality and purity of their gold, as well as their production processes and ethical standards.

LBMA approved gold bullion is widely traded and accepted in international markets, and it is often the preferred choice for institutional investors and central banks. When you invest in LBMA approved gold bullion, you can be confident that you are getting a product that meets the highest standards of quality and purity.

LBMA accreditation explained in simple terms

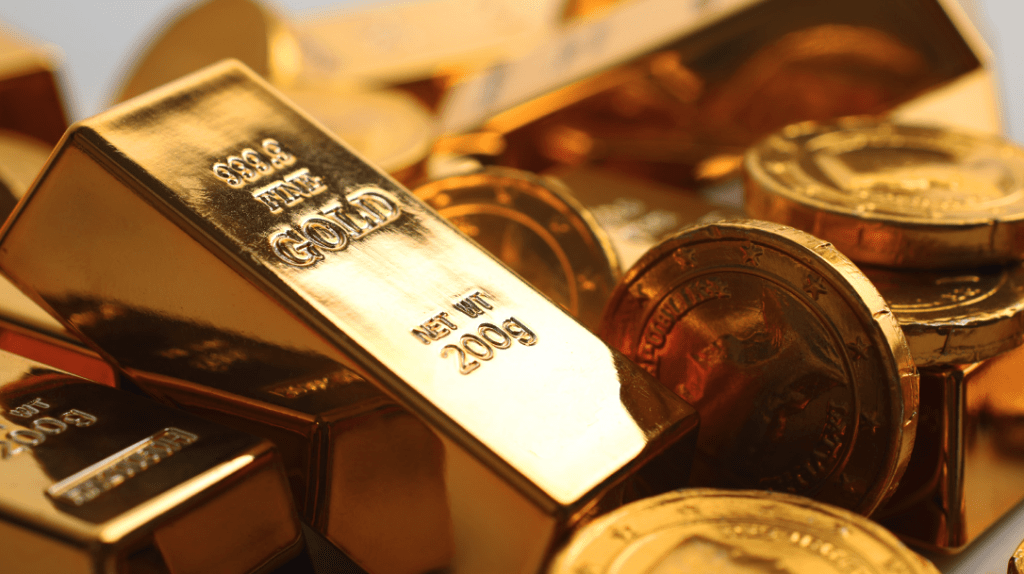

LBMA approved gold bullion refers to gold bars or coins that a manufacturer approved by the LBMA has produced. To maintain LBMA approval, a manufacturer must meet strict criteria regarding the quality and purity of their gold, as well as their production processes and ethical standards.

LBMA approved gold bullion is widely recognized and accepted in international markets, which can make it easier to buy and sell your investment when you need to. When you buy LBMA approved gold bullion, you can be confident that you are getting a product that meets the highest standards of quality and purity.

Where can you buy LBMA accredited gold bars?

At J Blundell and Sons, we only sell LBMA approved gold bars with full certificates, so you can invest with confidence. In addition, our gold bars come with full certificates, providing you with proof of their authenticity and purity. This can give you peace of mind when buying and selling your investment. Please head to Gold bars page

In conclusion, LBMA approved gold bullion is an important consideration for investors who are looking to invest in gold. By choosing LBMA approved gold bullion, investors can be confident that they are getting a product that meets the highest standards of quality and purity, which can be important if they are using the gold for investment purposes. If you are looking to invest in gold, be sure to do your research and choose a reputable dealer that offers LBMA approved gold bullion.