Collecting rare coins has long been a passion for many, offering not just a hobby but a valuable investment opportunity. At J Blundell & Sons, we specialise in providing a range of collectable coins that appeal to both seasoned collectors and those new to the market. With rare coins often increasing in value over time, they are a tangible asset that can bring both financial rewards and historical significance. Whether you’re drawn to the unique stories behind these coins or their potential for appreciation, collecting coins is an enriching pursuit.

The Value of Rare Coins

Rare coins are more than just beautiful pieces of history; they represent a unique investment opportunity. The scarcity of rare coins plays a significant role in their value. Coins with limited mintage or those minted to commemorate a special event often become highly sought-after by collectors and investors alike. As these coins age and become even rarer, their market value tends to rise. Whether you’re looking to diversify your investment portfolio or start a collection, rare and collectable coins offer a blend of history, culture, and financial potential.

Why Collectable Coins are a Smart Investment

Investing in collectable coins offers stability, particularly in times of economic uncertainty. Unlike stocks and bonds, the value of rare coins is less susceptible to market fluctuations. Over the years, many investors have turned to coins not only for their historical allure but also for their reliability as a store of value. At J Blundell & Sons, we offer a carefully curated selection of high-quality coins that have been authenticated and graded to ensure you are investing in genuine pieces with strong potential for appreciation.

Start or Grow Your Collection with J Blundell & Sons

At J Blundell & Sons, we take pride in offering a diverse range of rare coins for both collectors and investors. Our knowledgeable team is always ready to guide you through the process of selecting coins that meet your goals and interests. Whether you’re a seasoned collector or just getting started, we provide expert advice and top-tier service to help you make informed decisions. Our extensive collection features coins from around the world, each with its own unique story and value proposition.

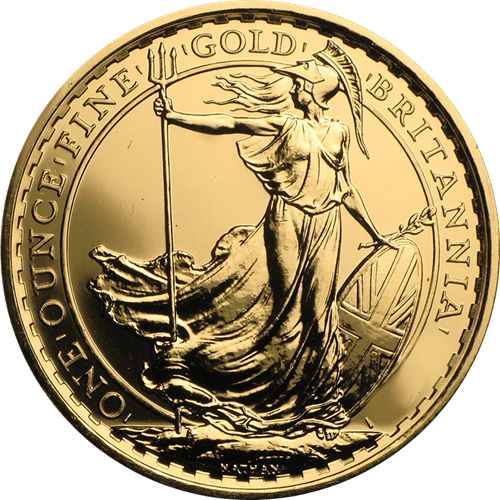

Featured Collectable Coins at J Blundell & Sons

At J Blundell & Sons, we offer an extensive collection of rare coins. Some of our current coins include these stunning coins and sets below.

The 2021 Full Sovereign; A striking example of British craftsmanship. Featuring a portrait of Queen Elizabeth II on the obverse and the iconic St. George and the Dragon on the reverse, this coin is highly sought after for its historical significance and detailed design. With limited mintage, this collectable coin is an ideal choice for investors and collectors alike.

2002 Elizabeth II 13-Coin Gold Proof Set – Golden Jubilee Edition; This rare 13-Coin Gold Proof Set celebrates Queen Elizabeth II’s Golden Jubilee, marking 50 years on the throne. Featuring 13 beautifully crafted gold coins, this set is a collector’s dream. Each coin is presented in proof condition, ensuring the highest quality finish. This limited edition is a must-have for royal enthusiasts and coin collectors who appreciate the artistry and historical importance of the British monarchy.

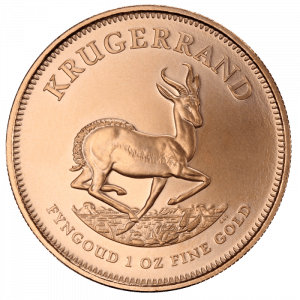

2017 South Africa 50th Anniversary Gold Proof Quarter Ounce Krugerrand Commemorates the 50th anniversary of the world-renowned Krugerrand. The 2017 Gold Proof Quarter Ounce Krugerrand is a remarkable addition to any collection. This South African coin is not only prized for its gold content but also for its status as a symbol of the global gold market. Limited in mintage and crafted to perfection, this coin celebrates the legacy of one of the most famous gold coins in the world.

At J Blundell & Sons, we offer these unique collectable coins, allowing you to invest in pieces that blend historical value with future potential. Contact us today to explore more about our full range of rare and collectable coins.